A couple of years ago, when KBC closed, I lost my primary bank for daily banking. I made the call to move everything to Revolut. That meant salary going into Revolut. People were shocked every time I mentioned this because traditional banks were for salary, neo-banks, like Revolut, were for splitting bills. So I did a double take recently when a friend of mine said they too were getting salary into Revolut.

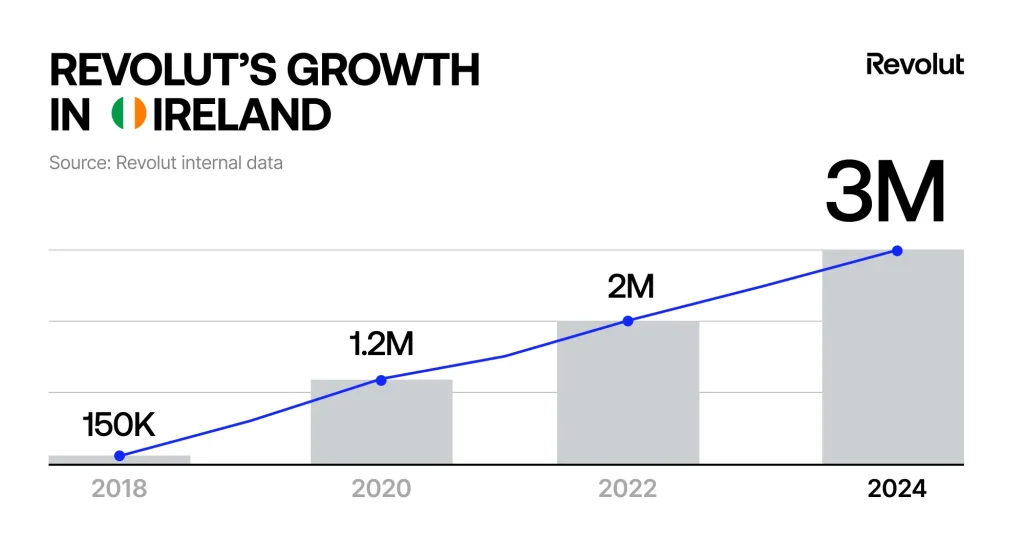

Revolut has grown, and is growing, massively in Ireland as people seek better digital banking experiences. Today, Revolut announced that they have reached 3 million customers in Ireland, adding to the neo-banks 50 million customers worldwide.

Revolut’s Growth

Revolut entered the Irish market in 2018 and by 2020 had 1.2 million customers. The appear of Revolut, in the early days, was splitting bills. You could go to dinner with friends, have one friend pay, and they sort it out later. I remember in the early days of Revolut, there would nearly always be one friend who didn’t have it while everyone else at the table nodded to “will I send you a split on Revolut”.

You could be sure that one person would be a Revolut customer the next time that question was asked.

This led to Revolut expanding their customer base to 2 million by 2022.

The Irish banking landscape lent itself to Revolut’s growing appeal over the years. Traditional banks were built on crumbling infrastructure and struggled to make even the most simple updates or innovations like mobile payments with Apple Pay or Google Pay. Revolut had digital in its DNA and was making short work of catching the core offerings of traditional banks.

On top of introducing loans and credit cards, Revolut launched a platform to help with booking holidays and, more recently, added the benefits of premium subscriptions for Revolut Premium customers.

One of the biggest logistical obstacles that Revolut overcame was the move to Irish IBANs in 2023. This overcame many issues, not least of which was IBAN discrimination. Employers who previously wouldn’t pay into non-Irish IBANs, despite European law stating all EU-IBANs should be accepted, could now pay all staff salaries into Revolut.

With that, the path was paved for today’s announcement, that Revolut has over 3 million customers banking with them in Ireland.

Revolut’s Customers in Ireland

Revolut’s primary customer base in the 3 million adult customers it has banking with them. This is around three-quarters of all adults in Ireland. On top of this, the neo-bank also has nearly 430,000 young customers on Revolut <18, approximately one third of all children in Ireland.

In addition to private banking, Revolut offers Business solutions too. These include a wide range of services like payments in store and invoicing. Nearly 28,000 businesses in Ireland use Revolut for their banking, up 33% in 2024 from 2023.

The Future of Revolut

Today, Revolut offers a massive range of solutions in a user-friendly app making banking easy. I’m a massive believer in looking after your financial health and one massive part of that is actually wanting to open your banking app. Revolt has made monitoring finances, but also applying for financial products incredibly easy.

And this is where the future of Revolut lies, answering the biggest question being asked of the company to date. Can you get a mortgage with Revolut.

Revolut has just reorganised its leadership, including Maurice Murphy moving into a Head of Lending role focusing on the European (and Irish) lending. Murphy says Revolut “will continue to bring the very best lending products to the market. In addition, we’ll soon be adding to the solutions we offer for shorter-term borrowing needs, and of course keep working hard on our imminent entry into the Irish mortgage market”.