In just a few short years, how we pay for goods and services have changed dramatically.

I can honestly say I rarely have a bank note on me, let alone any loose change. While I find card payments, especially contactless or mobile payments, really convenient, it wasn’t until today I thought about how charities are losing out on the donation of till-side loose change.

Do you know what I mean?

When you used to buy some groceries in the shop and they’d hand you twenty cent change, you probably popped it into the charity box. Well, that’s pretty much a thing of the past thanks to card and mobile payments.

At Dublin Tech Summit 2019, I caught up with Change Donations, a really smart company with a solution to bring donating loose change to charities into the age of digital payments.

Who Are Change Donations?

Change donations is an Irish donations service and the modern answer to popping your twenty cent change from your grocery shop into the charity box beside the till. Say you buy a few bits and bobs worth €19.60. Back in the day, you’d get two twenty cent pieces back and you might have been tempted to pop them into the charity box for a worthy cause. These micro-donations generally make little or no impact on your own pocket, but with thousands of them taking place around Ireland daily, they added up to a significant bit of cash for charities.

Today, you’re much more likely to tap your card and pay the exact amount for your transaction. Sure enough, you’re back up forty cents, but you likely won’t even notice that few cents. Charities, on the other hand, do miss the thousands of these transactions taking place daily and this is the gap Change Donations is trying to close.

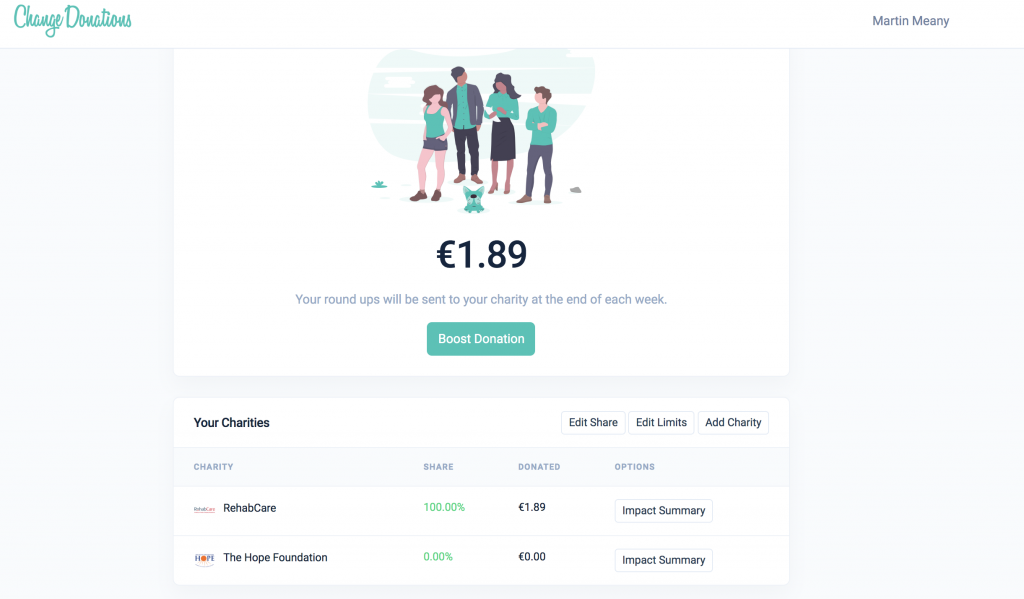

Change Donations is a service where you connect your bank account and your bank card. The Change Donations service then looks at your card transactions, rounds up to the nearest euro and donates your digital loose change to a charity of your choice.

Effectively, it’s the exact same as donating the loose change that the shop keeper would have handed back to you.

The example I gave earlier might be a bit rich for some people, so let’s take a closer look at how much control you have over the donations.

Controlling Your Change Donations

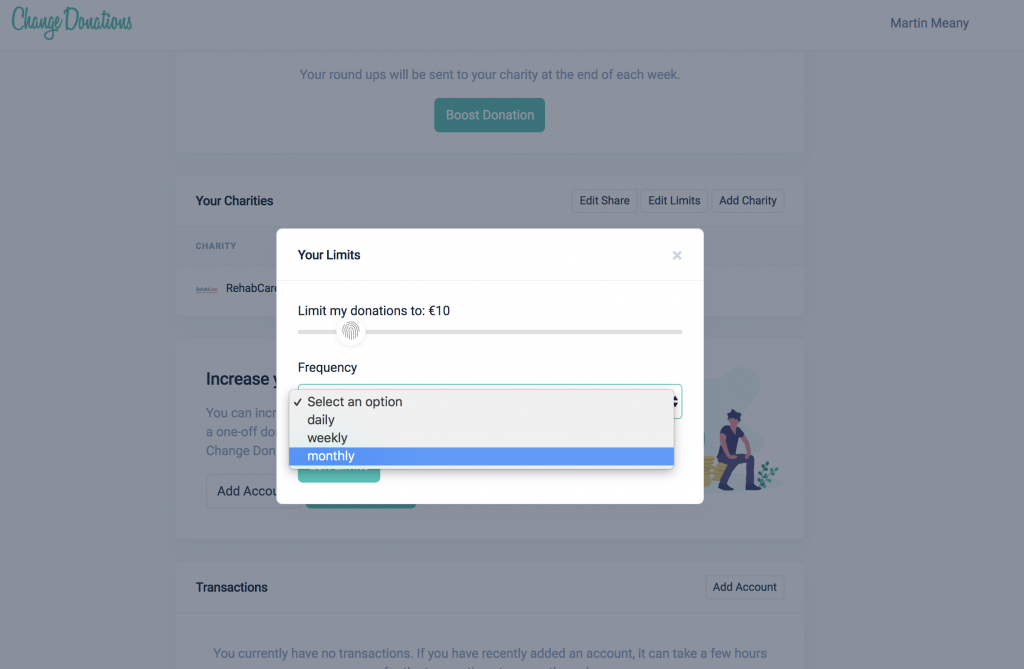

In the example I gave, some people might have preferred donating just twenty cents instead of the full forty, which is fair enough. While the platform can’t do this kind of break down you can control your total daily, weekly or monthly donations.

William Conaghan, a co-founder of Change Donations speaking about your donations, explained that “you can cap it at either a daily, weekly or monthly limit, let’s say five euro every month or five euro every day. Or you can turn it off”.

Simply set your limit to a fiver a month and you won’t be able to go over that.

If things are particularly tight this month, set your daily limit to zero and when things free up again, either raise your limits or boost your charitable contributions with a once off payment.

For added control over your donations, you can even split your contributions across several charities, choosing exactly which percentage of your digital loose change goes to which charity.

Where Does The Money Go?

Change Donations charge charities a 10% listing fee. This means charities receive 90% of the funds you send them. If your monthly limit is €5, your chose charity will get €4.50. This is a very similar setup to charities who request you donate by texting a keyword to a number to donate a small sum like €4. I looked at Like Charity who runs one of these SMS services and they also charge a 10% fee on donations. The big benefit for charities here is the simple fact that donations will likely be ongoing for months instead of a once off payment. That’s the beauty of microtransaction donations.

Benefits fo Local Clubs

When I met with the Change Donations team at Dublin Tech Summit, I had Jon with me and he quickly spotted the benefit for local clubs. Whether it be grassroots soccer teams or the local GAA club, there’s potential for Change Donations to expand beyond not-for-profits to sports clubs too. I think this is massively exciting for the Change Donations team because I’ve seen local clubs get behind these kinds of initiatives. Through this platform, clubs can mobilise their members, players, friends and families to make constant donations through micro-transactions, adding revenue streams the club can benefit greatly from while the people donating will barely even miss the loose change.

How Does It All Get Set Up?

I just ran through a test set up and it couldn’t be easier. When I chatted with the team behind Change Donations, my immediate concern was linking to bank accounts. Irish banks are notoriously un-digital so how could they possibly get the likes of Bank of Ireland and Permanent TSB accounts and cards linked to the Change Donations platform.

Lizzy Hayashida, the co-founder of the service, outlined how it works, stating they “work with two partners. One that lets Change Donations link your bank account and see transactions. That’s ‘read-only’. Then we work with Stripe to make the donation on your behalf to the charity”.

When I set up my Change Donations account this evening, it was remarkably easy and felt very similar to the process which I recently went through while adding a Bank of Ireland account to my KBC account thanks to some PSD2 innovation. While this isn’t a PSD2 integration, it is something the team is looking at down the line.

For the time being, to get set up, you add your online banking credentials into the Change Donations system which allows the system to see your transactions. For the more security conscious of you out there, be rest assured. Change Donations uses 256-bit TLS bank-level encryption. Without getting technical, that’s some serious encryption!

You then add the card you’d like to donate spare change from and voila! You’re ready to go. Quite brilliantly, Change Donations has been cleverly designed that from day one you can use the service with Bank of Ireland, KBC, AIB, Ulster Bank and Permanent TSB.

Change Donations: The Verdict

Being totally honest, Change Donations is one of the most exciting ideas I’ve seen in a long long time. I’m a Revolut customer and I do use a feature they have which rounds up my digital loose change into a savings vault. I’ve racked up over €100 euro, purely from rounding off my transactions. I can personally vouch for the theory that you don’t feel the micro-transactions or micro-transactions leaving your pocket.

With the ability to place a limit on the rounding up of your digital loose change, you can strike a happy balance between donations and savings. Everybody wins.

What makes me most excited about this platform is just how on track it all is to be a success. I can really see GAA clubs and football teams around the country getting their members to sign up. Some might focus on the 10% service fee, but in truth, the 90% of donations that charities or clubs do get will be practically a completely new source of income. More importantly, it’s going to be a fairly regular stream of income.

Watch out for these guys. Change Donations is currently in BETA and will launch fully in Ireland, later this year.